What are Closing Costs?

The closing process in a real estate transaction finalizes the terms of an agreement between the buyer and seller, leading to the transfer of the property’s title. This step of the buying/selling process comes with its own set of costs. Before a buyer can hold the keys to their new home, and before a seller can celebrate the sale of their property, closing costs must be paid.

What are closing costs?

The term “closing costs” refers to the various expenses, taxes, and fees paid by both the buyer and the seller to finalize a real estate transaction. The purchase agreement—signed by both parties—will dictate the terms of how the closing costs are paid, but there are some standards about who pays what.

In general, buyers can expect to pay about 2-5% of the total purchase price in closing costs, while sellers’ costs can range anywhere from about 6-10%; the difference being that buyers are using extra cash to pay for their closing costs while the amount sellers owe is typically deducted from the proceeds of the sale of their home. Note—these percentages may vary depending on property taxes, insurance rates, and other factors involved in the transaction.

Closing Costs for Buyers

Typical mortgage-related closing costs for buyers include an application fee, an underwriting fee, and prepaid interest (the accrued interest cost between your settlement date and first monthly payment). If you make less that a 20% down payment on the home, you can expect to pay your lender for private mortgage insurance (PMI), as well.

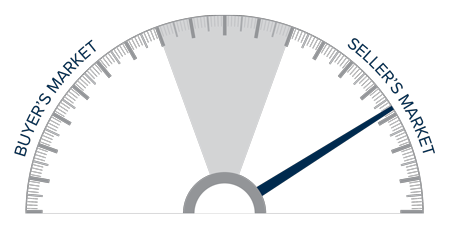

Two main property-related closing costs for buyers are the appraisal and the home inspection. Lenders will require an appraisal to double-check that the value of the property matches your mortgage loan amount, which will typically cost you a few hundred dollars. A home inspection provides the buyer with a clear understanding of the home’s condition and what repairs need to be made, either in the future or before closing. In competitive markets (a seller’s market), it’s more common for sellers to conduct pre-listing inspections and for buyers to waive the inspection contingency to make their offer more appealing. Buyers will also pay a variety of title, insurance, attorney, escrow, and property tax fees to finalize the home purchase. Usually, your lender will require you to purchase homeowners insurance before settlement to protect against insured disasters that may occur on the property.

These are just some of the costs inherent in the closing process for buyers, which are a fraction of the total costs of buying a home. Working with a Buyer’s Agent will help you stay organized as you navigate through these crucial final steps of your home purchase.

Image Source: Getty Images – Image Credit: PeopleImages

Closing Costs for Sellers

The seller will pay the agent commissions on the sale, typically to both the buyer’s agent and the listing agent. Agent commissions usually come in at around 4-6% of the sale price of the home. Other closing costs for sellers may include attorney fees, title insurance, a transfer tax, and the home’s property taxes for the current year if they have not yet been paid. The terms of the agreement will spell out what the seller is additionally responsible for, including HOA fees if applicable and any escrow money promised to the buyer.

Typically, escrow fees are shared between the buyer and seller, which cover the costs of distributing the funds involved in the transaction. In buyer’s markets, it’s more common for sellers to agree to pay for a portion of the closing costs—what is known as “seller concessions.” A common example of a seller concession is when the seller agrees to pay for repairs discovered during the buyer’s home inspection.

So, whether you’re buying or selling a home, it’s important to remember that a series of fees and payments must be completed to finalize the transaction. Learn more about the costs of buying and selling a home here:

The post What are Closing Costs? appeared first on Windermere Colorado REALTORS.